The first thing you need to understand in this regard is that there is nothing like THE best payment gateway. All the options available out there in the market have there own advantages and disadvantages. So, the term best payment gateway applies with respect to your particular requirements. Now let’s dig deeper!

What is a Payment Gateway?

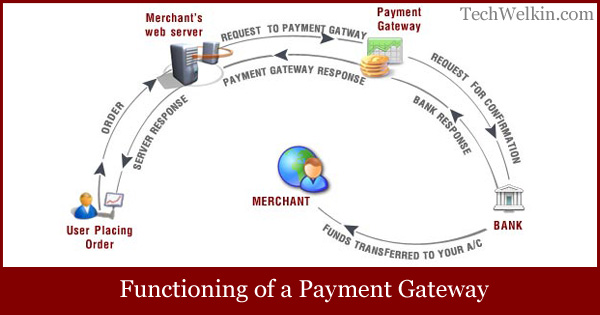

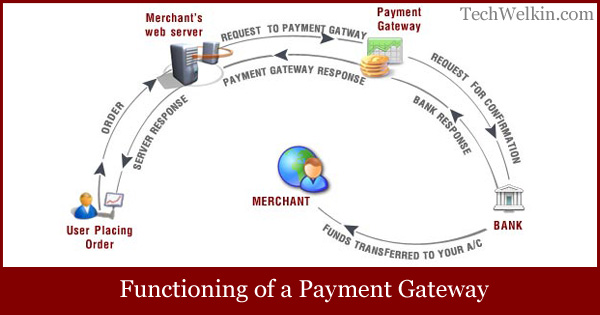

In simple terms, payment gateway is a service that authorizes the credit card or other forms of electronic payments like online banking, debit cards, cash cards etc. Such a facility is not only important for huge and well established businesses —but also these are useful for home based online entrepreneurs. Payment gateway acts as a middleman between the bank and the merchant’s website or mobile application. When a user wishes to make a payment, the merchant’s website sends the encrypted credit card information to the payment gateway. Then the payment gateway confirms the validity of these details with the bank and the required amount of money gets transferred from user’s account to the merchant’s account. Flowchart given below shows how a typical transaction takes place through a payment gateway.

Best Payment Gateways in India

Following are the best payment gateway service providers in India. These gateways have been selected on the basis of their market share, commission charges and reputation of promoters etc. Please note that these payment gateways are not given in any particular order. To stay in competition, these companies keep on revising their commission fee and also make discount offers from time to time. It is advisable that you visit their websites to get to know the on-going discount offers.

InstaMojo

If you’re a startup entrepreneur or a freelancer which sells digital products like eBooks, music, videos, tutorials etc. then InstaMojo is a very good choice for you. InstaMojo is an Indian startup company setup by Aditya Sengupta, Akash Gehani, Harshad Sharma and Sampad Swain in 2012. They offer seamless payment collection facility at attractive rates. InstaMojo can host your digital content and you can provide a “Buy Now” button on your website. On clicking this button, the customer will be able to buy your product without even leaving your website! Instamojo charges 1.9% of the successful transactions. If you want to host your content on their website, they will charge 5% of the transaction. InstaMojo will collect the money on your behalf and send the amount in your bank account within 3 business days. For example, if you price a song at Rs. 100 and sell it through InstaMojo, you will get Rs. 97.83 in your bank account. InstaMojo will deduct Rs. 1.9 as their fee and Rs. 0.27 as service tax. InstaMojo does not charge any setup fee.

PayU India

PayU India is a subsidiary of the global firm PayU. It was launched in 2011 by Ibibo, which is co-owned by Naspers and the Chinese Internet service portal Tencent. PayU also has presence in countries like South Africa, Hungary, Poland and Russia among others. PayU can process payments with Visa, MasterCard and Diners credit cards; debit cards of more than 50 banks; and online banking for banks including ICICI, HDFC, SBI, and Axis Bank. Here is the rate list of PayU India:

Debit Cards Rs. 2000 or less: PayU will take 0.75% commission More than Rs. 2000: PayU will take 1% commission Credit Cards, Online Banking or Multi-bank EMI Upto Rs. 4,900: Commission is 3.90% Upto Rs. 9,900: Commission is 3.25% Upto Rs. 19,900: Commission is 2.90% Upto Rs. 29,900: Commission is 2.50% Amex, Cash Cards and PayUMoney Upto Rs. 4,900: Commission is 3.90% Upto Rs. 9,900: Commission is 3.25% Upto Rs. 19,900: Commission is 3.25% Upto Rs. 29,900: Commission is 3.25%

They claim to offer you a conversion rate of over 12% as they deploy features like 1-click checkout, dynamic switching, retry framework and recommendations. PayU India’s system can store card details for customer and the subsequently purchases can just be a 1-click affair. Customer will have to enter only the CVV and 3-D secure password when doing the next transaction.

Setup fee of PayU India PayU India charges from Rs. 6,000 to Rs. 36,000 as setup fee. Fee varies on the basis of various plans that they offer: PayU also charges a flat annual maintenance fee of Rs. 2400 on all plans.

Citrus Pay

CitrusPay has an interesting commission scheme, they charge a flat 1.99% + Rs. 3 for every transaction made through them. CitrusPay charges Rs. 1,200 towards annual maintenance fee. They claim to be able to capture EVERY single payment and therefore have a very high conversion rate. Citrus is also known for the good levels of security through transaction process. Their technology is world class. Needless to say, Citrus also provides API for your developers to seamlessly integrate the payment gateway features into your website’s structure and requirements. If you decide to use Citrus as your payment gateway, you wouldn’t have to worry much. An easy sign-up will give you the code to embed payment form from Citrus in your website. After sign-up, you can send the required documents in two weeks time. Once your documents are received and verified by Citrus, your payment gateway will begin to function. CitrusPay was incorporated in 2011 by Satyen Kothari and Jitendra Gupta. Now it has a great market reputation and an enviable list of clients.

CCAvenue

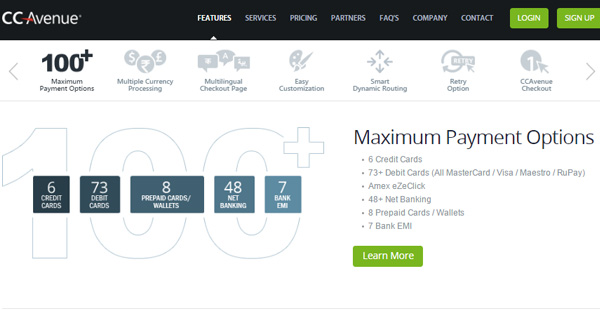

CCAvenue is the biggest payment gateway in India with over 80% of e-commerce merchants in Indian market are using their services. They offer a large number of payment options:

7 Credit Cards (MasterCard, Visa, American Express, JCB, Discover, Diners Club, eZeClick) 73+ Debit Cards (All MasterCard / Visa / Maestro / RuPay) Amex eZeClick 48+ Net Banking 8 Prepaid Cards / Wallets 7 Bank EMI

CCAvenue helps you to take your business international! They allow you to accept payment in 27 major currencies (including USD, GBP, Euro, Yen, Yuan etc.) Another great feature that CCAvenue offers is the multilingual check-out page. Majority of Indian e-merchants don’t yet recognize the importance of languages other than English, but trust me, regional languages are extremely important. Not everybody is comfortable with English in India. CCAvenue allows customer to see the check-out page in the language that they understand the best. They offer interface in 18 major Indian and International languages. Now here are the commission rates that CCAvenue charges: As we can see, CCAvenue’s commission rates are much higher than competitors in the industry. But they claim that they make it all up by provide the best payment gateway available in India. Have you used CCAvenue? What has been your experience?

EBS Payment Gateway

EBS is a company owned by France-based Ingenico Group, which is a global leader in the payment processing and services. EBS has offices in Delhi, Mumbai, Kolkata, Chennai and Bangalore. They have several plans for you to choose from and commission rates for net-banking and credit cards range from 2.75% to 3.75%. For debit cards EBS takes 1.25% to 1.50% commission. A minimum setup fee of Rs. 11,999 and annual maintenance fee of Rs. 2,400 is also to be paid. EBS gets mixed reviews from users about their quality of service.

PayPal Payment Gateway

PayPal is not just any other payment gateway! When it started, it was a revolutionary idea of sending money through email. For small online businesses, PayPal is a great option. Those who can not afford other means of payment processing, PayPal provides them a simple and inexpensive way of doing business. I have written an article on how PayPal works, you can read it to get a better understanding. If you’re selling any service or product on your website, PayPal can bring payment from your buyer into your bank account —and PayPal takes 4.4% + $0.30 USD commission for this. If you’re selling through eBay, then PayPal charges only 3.9% + $0.03 USD. If you’re earning from online business, you can request payment from your buyer through PayPal. You can also send money through this service. It’s easy, simple and effective.

PayZippy

Update: Flipkart has shutdown PayZippy and instead they are now investing money in ngpay. This new kid of the block has been developed by Flipkart —the leader in the Indian e-commerce industry. PayZippy offers you easy interface for integration into your website. They have plug-ins for several popular platforms, including WordPress, Magento, OpenCart, ZenCart, PrestaShop etc. SDKs are available for PHP and Java. If you want to integrate PayZippy into your mobile app, they have made ensured that you will not have to toil much on the development. An extensive PayZippy API will ensure that you can do seamless integration of payment gateway in your mobile app. Here is the list of PayZippy charges:

VISA, Mastercard and Maestro Debit Card Pricing Rs. 2000 or less: PayZippy commission would be 0.75% More than Rs. 2000: PayZippy commission would be 1% VISA and Mastercard Credit Card / Net-Banking Pricing Rs. 0-5 lakhs: PayZippy commission would be 3.50% Rs. 5-10 lakhs: PayZippy commission would be 3.25% Rs. 10-25 lakhs: PayZippy commission would be 3.00% Rs. 25-100 lakhs: PayZippy commission would be 2.50% Rs. 1 Cr or above: Contact PayZippy to get rates American Express Cards PayZippy commission would be 3.50% International Credit/Debit Card Pricing Domestic fee + 1.50% over and above that

Please note that the above rates do not include service tax (which has recently been increased from 12.36% to 14%). PayZippy deploys extensive security checks for all the transactions taking place through it. They also send Email and SMS alerts for all the transactions to keep you informed of how your business is doing. PayZippy can optionally save customer’s card details so that the next time he can swiftly make payments. PayZippy APIs allow you to integrate card details form right in your own website. I hope this list of best payment gateways in India will help you in selecting a suitable payment gateway for your business. Selecting the right payment gateway is an important decision to make. So, I would advise you to take your time, do your research and then make an intelligent decision. Should you have any questions in this regard, please feel free to ask in the comments section of this article. I will be happy to try and help you. Thank you for using TechWelkin.

- Is there a payment gateway which does the authorization on the native website? i mean i don’t want user get redirected to payment gateway website.

- Also if the authorization is done on my website, should i only take care of the PCI compliance part as well ? I am an engineer and have been planning to enter online retailing in near future.I have created my own website and bought the hosting. I want to know can I integrate payment gateways on my own? or is it necessary to get it done by a professional? Many thanks I am in an online business. I need to load funds to the payment gateway so I can buy the products from the merchant site. I filled in the ICICI funds transfer abroad form twice online but was rejected because the cause and reason did not match. I had to register with VX Gateway Inc as the merchant site uses this gateway. I am not able to load funds into it using my bank account. VX provided all the details, but something is going wrong with what I am filling up at the bank end.

- they do not have many integration possibilities for WordPress built sites

- their Woocommerce plugin does not work

- their tech support team keeps giving canned replies and then directing to some third party for ‘further help’ – which also does not reply as promptly. Please make some suggestions Thanks for the article…